Binance Vs FTX: What Really Happened to 'Crypto King' Sam Bankman-Fried and his Company?

How Sam Bankman's company FTX Group including FTX and Almeda Research fell from $32 billion valuation to Bankruptcy? Did CZ Binance created this chaos or what went wrong with Sam?

On June 2022, FTX's founder or CEO Sam Bankman was named the JP Morgan of Crypto by Anthony Scaramucci - the former White House Director of Communications. Fast forward to November, Sam and his company have filed for Bankruptcy due to a liquidity crisis.

Yes, Sam's FTX Group(including FTX and its 130 associated companies) released a statement o filing bankruptcy protection in the US on November 11. Founder and CEO of FTX, Sam Bankman-Fried also resigned from his role.

But, how did FTX, a company worth $32 billion come into a situation that made them ask for help from its competitor Binance? And EVEN WORSE Binance declined by inculpating them of mishandling customer funds. And all these happened in just a SPAN OF A WEEK.

FocusUsTech takes a deep dive into the current situation of FTX and what led to these circumstances. Did Binance play to take out its biggest competitor completely from the market?

What happened with Binance and FTX?

Early November(2022) has been a crazy week in the crypto market as a series of events nearly result in Binance –the largest cryptocurrency exchange platform nearly acquiring its biggest competitor- FTX.

However, people have a misconception that all these things happened too fast due to mistakes by FTX's CEO Sam. But what the community is missing is the long COLD War between the two CEOs in the competitive market.

Untold Rivalry between 2 CEOs

Well, the news is clear, FTX Group is insolvent and they have already commenced voluntary proceedings and review of its balance sheet or simply a BANKRUPTCY.

Before directly jumping into the story, let’s look at a little background about the position of both companies before all happened.

Binance – Founded in 2017 by Changpeng Zhao in China, Binance is the undisputed king of the crypto exchanging platform in terms of volume. Despite having huge competition by coin base, Binance got its first position in January 2018. At that time, its market capitalization was $1.3 billion. Since then, CZ has never turned back.

FTX – Amidst the Binance dominance, Sam Bankman-Fried along with Gary Wang founded the company in 2019. It allows transactions of more than 300 cryptocurrencies. According to Forbes, the latest valuation of FTX is $32 billion after raising $500 million in January 2022. Sam is also the founder of Almeda Research, a Hongkong based private equity firm.

Remember the name Almeda Research- Plays a big part later in the story.

Not only the platforms, the duo too competes in being the richest founders in the crypto space. As per Business life, Zhao sits at the top with $18.3 billion while Sam is second with $15.6 billion.

Changpeng Zhao vs Sam Bankman-Fried

Changpeng Zhao vs Sam Bankman-Fried

Binance's CZ and FTX's Sam Bankman's Feud

1. Sam’s support for Politics and Zhang's opposition to it

Zhang and Sam has a long history of rivalry going on between them. Reports claimed that SBF has donated more than $40 million to Democrats and Republicans in running political campaigns. And CZ has been against Sam’s Support of politics.

CZ has even called FTX or Sam Bankman the people who lobby against other players of the Crypto industry behind their backs. The below statement was given in reference to Sam funding millions of US Democrat politicians and also trying to influence for closer regulations as he tweeted (clearly targeting FTX),

"We are not against anyone. But we won’t support people who lobby against other industry players behind their backs"

2. Sam's Controversial Manifesto

On October 20, Sam Bankman published his own regulatory manifesto “Possible Digital Asset Industry Standards where he discussed 7 different aspects including Tokenized Equities, Customer Protections, Disclosures and Suitability, Sanction and Blocklists, Defi, and others.

In a section of Sanctions, he has proposed a centralized application to control the address that can transfer and accept funds.

Some of these contradict the idea of decentralization which CZ and his company Binance strongly stands for.

1) As promised:

— SBF (@SBF_FTX) October 19, 2022

My current thoughts on crypto regulation.https://t.co/O2nG1VrW1l

3. Keyboard Wars between 2 CEOs

The keyboard wars have been going on between the two CEOs for some time, but it all peaked when Bankman fired a shot at Binance CEO on October 30. In a deleted tweet FTX founder Sam replied to one of the tweets of co-CEO of FTX Digital Markets Ryan Salame. Ryan tweeted,

"Been an absolute pleasure watching @cz_binance have the extremely difficult but transformative debates on twitter this past week to ensure the crypto industry moves forward in the best possible way.”"

Sam replied,

“Excited to see him repping the industry in DC going forward! uh, he is still allowed to go to DC, right?"

The tweet was made in Zhao’s doubtful legal states in the United States. Also, Sam hinted at alleged “crypto money laundering to Binance”.

Lmfao, the tweet that potentially pushed the feud over the edge has been deleted. pic.twitter.com/AzMiCGQYnG

— Hsaka (@HsakaTrades) November 8, 2022

What went wrong with Sam and his FTX?

On November 2, Coindesk revealed a very interesting relationship between FTX – an exchange firm with Alameda Research which is a trading firm and both were founded by SBF.

As per the reports by Coindesk, the leaked balance sheet of Alameda has $14.6 billion of assets till June 30 of 2022. However, it also revealed that most of the assets of the trading firm were FTX’s token, FTT. Among $14 billion assets, two major assets(40% of total assets) - $3.66 billion unlocked FTT and $2.16 billion FTT collateral were linked to FTT.

Similarly, the company had $7 billion in liabilities, $292 million was of locked FTT while the remaining was dominated by loans.

This exposed balance sheet has made a huge tie between FTX and Alameda ultimately the questionable financial situation of Sam Bankman’s company Alameda Research.

In response to Alameda’s CEO, Ellison stated that the leaked financial sheet does “not reflect” all the assets that are worth billions.

A few notes on the balance sheet info that has been circulating recently:

— Caroline (@carolinecapital) November 6, 2022

- that specific balance sheet is for a subset of our corporate entities, we have > $10b of assets that aren’t reflected there

CZ Dumped the whole FTT token held by Binance

As soon as the report was leaked by CoinDesk, Zhang immediately revealed that he and his company has decided to liquidate all the FTT – which was around $2.1 billion.

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

The revelation was cold enough to send shock in the crypto world. Later, CZ cleared out why he decided to make the liquidation of such a huge amount as a part of their Post-Exit Risk Management technique.

Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won't pretend to make love after divorce. We are not against anyone. But we won't support people who lobby against other industry players behind their backs. Onwards.

— CZ 🔶 Binance (@cz_binance) November 6, 2022

No surprise that Changpeng Zhao's decision on liquidating all the FTT tokens was affected by his experience of what a faulty system could lead a system towards.

The Luna-Terra Crash, earlier this year is fresh which led to the wiping of $60 billion cash from the digital currency space.

CZ also promised that he would sell the token in a way that would not affect the market. Hence concluding that he would sell those tokens over time even if it takes multiple months.

We will try to do so in a way that minimizes market impact. Due to market conditions and limited liquidity, we expect this will take a few months to complete. 2/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

So, Zhang's intention was clear - he would definitely sell those tokens but keeping in mind the market. In the same Twitter thread, he diplomatically told,

We will try to do so in a way that minimizes market impact. Due to market conditions and limited liquidity, we expect this will take a few months to complete. 2/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

We typically hold tokens for the long term. And we have held on to this token for this long. We stay transparent with our actions. 4/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

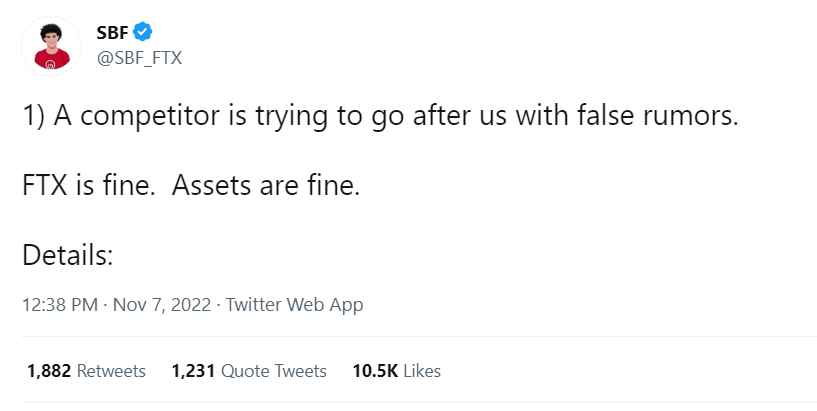

SBF Blamed his competitor for making FAKE rumors

The next day, on November 7, SBF came out on Twitter as he denied all the accusations by CZ and Binance. He even called out them for making false rumors as he claimed FTX is good enough to cover all of his client holdings.

SBF Deleted Tweet saying assets are fine

Bankman also affirmed that FTX never invests in clients' assets and has a history of safeguarding client assets. Also, he mentioned CZ Binance that would love to work together for the crypto ecosystem.

Failed Attempt by Almeda Research to Redeem FTX

CZ's announcement was sure to bring a heavy turnaround in the open market. So, Caroline Ellison proposed to buy all the Binance holdings of FTT in a closed room -without affecting the market at the cost of $22 per FTT.

@cz_binance if you're looking to minimize the market impact on your FTT sales, Alameda will happily buy it all from you today at $22!

— Caroline (@carolinecapital) November 6, 2022

A clear transaction in which both sides benefit. Binance could sell all of its FTT tokens directly and Caroline could buy them all at the rate of $22 inside the wall.

However, CZ denied selling those tokens directly to Caroline - the CEO of Almeda Research as their plan to rescue the upcoming disaster went all in vain.

Panic in the Crypto Market

Soon after the CZ's announcement of his decision on dumping FTT tokens, the crypto market went Crazy as every FTT token investor was seeking to sell their held tokens which caused panic in the market.

Following the crypto withdrawals, FTX Echange even halted all the crypto withdrawals as one of the employee of FTX revealed,

“Any transfers besides fiat are halted,”

Later Sam Haltman confirmed that the FTX is fully operational as customers can sell and buy normally. He wrote,

“FTX.US’s withdrawals are and have been life, are fully backed 1:1, and operating normally.

Later, it was revealed that Binance was not the first company Sam and FTX looked for help.

FTX' Ask for Support From Binance

Whatever needs to happen will happen. Yes, not even 24 hours after his claims about FTX's safety, Binance revealed the news that would later shock the Crypto world.

On November 8, the Co-founder of Binance, CZ revealed that FTX asked for the help of Binance. Reports have been circulating that FTX could crash due to a series of unfortunate events that led to a surge of customer withdrawals from the platform.

This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire https://t.co/BGtFlCmLXB and help cover the liquidity crunch. We will be conducting a full DD in the coming days.

— CZ 🔶 Binance (@cz_binance) November 8, 2022

The news was also approved by the FTX founder, Sam Bankman Fried as he tweeted,

“We have come to an agreement on a strategic transaction with Binance.”

Was it CZ's Masterplan: Create Panic and Buy FTX?

As soon as the news spread that Binance had offered to buy its competitors, some analysts even predicted that it was all CZ's plan from the very beginning.

One of CNBC's Tech Correspondents Ryan Browne stated that Binance's CEO started the whole drama of creating doubt in the Almeda and FTX company which led investors to panic.

So just to be clear... Binance's CEO raises doubts over the financial health of Alameda/FTX, thus causing investor panic around FTX leading a ton of investors to move their funds out, only to then... buy the company outright??

— Ryan Browne (@Ryan_Browne_) November 8, 2022

Binance Ditched FTX

Amid the agreement of a non-binding LOI between FTX and Binance, the owner of Binance has confirmed that they are walking out of their possible acquisition of FTX.

He has also openly stated the reason for them backing out of the deal as he wrote on Twitter,

As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of https://t.co/FQ3MIG381f.

— Binance (@binance) November 9, 2022

He made it clear that, due to the alleged US Agency investigations going on with FTX due to possible mishandling of customer funds by FTX.

Amidst the silent competition between the two crypto exchange spaces, Binance claimed to try to help its competitor for the ecosystem.

Every time a major player in an industry fails, retail consumers will suffer. We have seen over the last several years that the crypto ecosystem is becoming more resilient and we believe in time that outliers that misuse user funds will be weeded out by the free market.

— Binance (@binance) November 9, 2022

However, the situation has already gone beyond the control of Binance as they said,

In the beginning, our hope was to be able to support FTX’s customers to provide liquidity, but the issues are beyond our control or ability to help.

— Binance (@binance) November 9, 2022

Investigation on FTX

Why would Binance just not acquire FTX which means they just did not take out its biggest competitor but owned it? It would have been beneficial for both parties as FTX would be saved while CZ got its competitor in its hands.

As previously mentioned by CZ Binance, - mishandled customer funds and alleged US agency investigations. Yes, on November 10, California's Department of Financial Protection and Innovation announced that the FTX group was under investigation. And the absolute reason was "apparent failure". One of the spokespeople told,

"investigating the apparent failure of crypto asset platform FTX."

DFPI also urged the investors or anyone to contact them if they feel they have been impacted by the FTX event.

"The DFPI takes its oversight responsibility very seriously. We expect any person offering securities, lender, or other financial services provider that operates in California to comply with our financial laws. If you have been impacted by these events, please contact the DFPI online"

That's the major reason Binance backed from buying FTX.

FTX US is Safe: Sam Bankman's False Hope

Despite all the events going against him, Sam continued saying that his separate FTX company for the United States was safe. From time to time, he acclaimed that, FTX US (Not FTX international) was fully liquid and was not impacted even 1% by the events. He stated,

19) A few other assorted comments:

— SBF (@SBF_FTX) November 10, 2022

This was about FTX International. FTX US, the US based exchange that accepts Americans, was not financially impacted by this shitshow.

It's 100% liquid. Every user could fully withdraw (modulo gas fees etc).

Updates on its future coming.

Filing of Bankruptcy

A day later, Sam Bankman Fried confirmed that he hand his company FTX along with Almeda Research filed for Bankruptcy in the United States in a Twitter thread. Also, he has stepped down from his role as CEO of the company.

1) Hi all:

— SBF (@SBF_FTX) November 11, 2022

Today, I filed FTX, FTX US, and Alameda for voluntary Chapter 11 proceedings in the US.

FTX officially declared that all of the companies - FTX, FTX US, Almeda Research Ltd., and other 130 companies have filed for bankruptcy. Eventually, John J. Ray III was appointed as the new CEO of the FTX Group.

Press Release pic.twitter.com/rgxq3QSBqm

— FTX (@FTX_Official) November 11, 2022

FTX also revealed that they have $10 billion to $50 billion in both assets and liabilities each and 100,000+ creditors.

Sam Bankman's Reaction to rumors of him fleeing to Dubai

After everything was over, as FTX officially announced themselves as Bankrupt, rumors have been going on about Sam and his other partners trying to flee to Dubai or Argentina. It all started when users tracked Sam's private jet coordinates.

The rumour is SBF on his way to Argentina.. pic.twitter.com/Jnxm3bprm9

— CoinMamba (@coinmamba) November 12, 2022

In a text message with Reuters, Sam Bankman denied the rumors that he had fled to Argentina when asked about his whereabouts.

Timeline of events of the FTX Crash

- October 30 - Sam Bankman poked CZ about his residency in the US

- November 2 - Coindesk leaked the Balance sheet of Alameda Research and its link to FTX

- November 6 - Alameda Research's CEO Caroline denied the 100% accuracy of reports by Coindesk

- November 6 - CZ Binance announced to Dump of whole FTT Tokens

- November 6 - Alameda's CEO Caroline tried to buy all holdings of Binance

- November 7 - SBF accused CZ of spreading fake rumors

- November 8 - FTX seeks help from Binance and non - a binding LOI signed

- November 10 - DFPI announced an investigation on FTX

- November 10 - Binance backed out of the deal

- November 11 - FTX Group announced Bankruptcy

Read more at FocusUsTech.

Tags

Comments

warning You need to Sign Up to Comment